Unrealized Potential in Online Food Retailing—Fresh Delivery Service Coverage Primarily in Metropolitan Areas (by Julia Pott, source from iXtenso)

Prior to the launch of Amazon Fresh in Germany, many e-commerce observers expected brick-and-mortar grocery retailers to do everything in their power to fight back with their own offers and services. This prediction has not come true. Several of the big retail chains developed digital strategies and experimented with online delivery services. However, some (Lidl, Kaufland, Real) very quickly abandoned these efforts again, when they didn’t instantly turn a profit, while others (e.g. Aldi) didn’t even try to compete.

Slow start in Germany despite high growth potential

While online retail in Germany has reached a large percentage, especially in the fashion, electronics, and IT sectors, online food retailing gets off to a very slow start. Although the market indicated above-average growth according to the HDE Online-Monitor from 2017, this took place at a very low level.

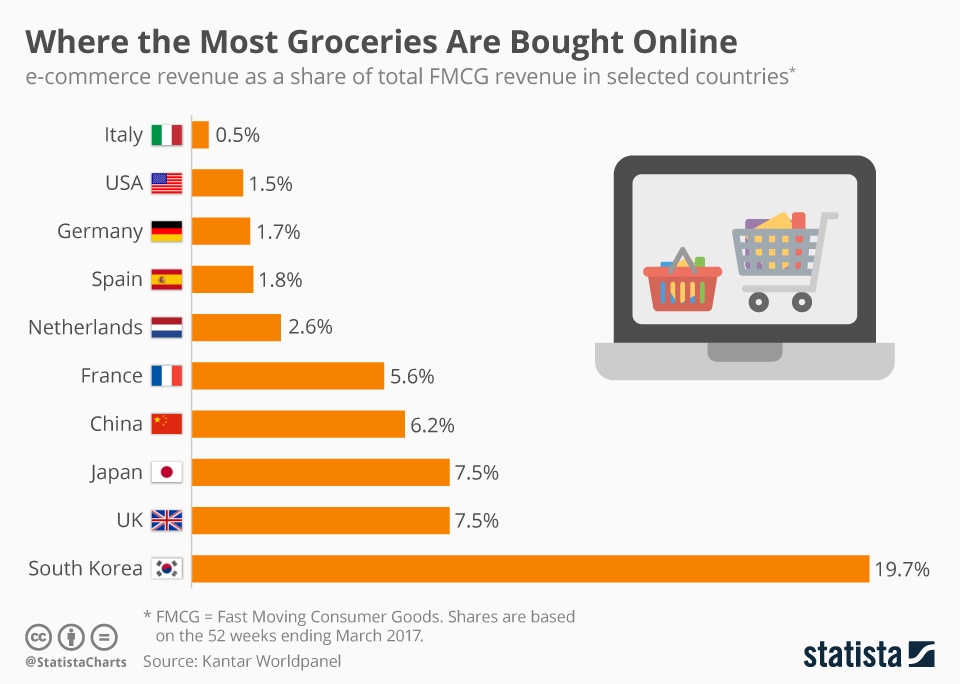

(Source: Kantar Worldpanel / statista.com)

Meanwhile, a comparison with other countries indicates that there is fundamental potential for online food retailing. According to the Kantar Worldpanel, the online percentage of FMCG sales (fast-moving consumer goods) amounts to 20 percent in South Korea, while it accounts for at least 7.5 percent in Great Britain (compared to 1.7 percent in Germany). The difference is especially apparent when it comes to per capita spending in Great Britain; at an annual 154 Euros compared to 18 Euros, it is at a much higher level according to an online food retailing study by the A.T. Kearney consulting firm.

Even though 16 percent of Germans occasionally purchase groceries online, only 1.4 percent use this option to buy at least half of their overall grocery products according to a study by Ernst & Young from the spring of 2017. ”The fundamental willingness of Germans to order groceries online today is already strong. […] However, we are still waiting for the breakthrough of online grocery shopping,“ says Joachim Spill, Technology, Media and Telecommunications Leader at EY in a press release. “So far, the grocery segment has lacked truly strong and comprehensive available online options that also include fresh foods.“

Creating a hassle-free ordering process

According to a Bitkom Research survey in December 2016, German consumers are still skeptical and question whether fresh foods ordered online have the same quality as store-bought items. Waiting for deliveries and shipping costs are also mentioned as the main reasons why customers continue to shop at brick-and-mortar stores. The minimum order quantities and free shipping order minimums of some retailers are set quite high. For example, the minimum order value for Edeka’s online supermarket Bringmeister in Berlin is 40 Euros, though beverages are not included in this amount. Delivery fees are waived for orders over 100 Euros.

If a customer has completed his/her shopping order, but a higher priced item is suddenly not available and causes him/her to drop below the minimum order amount, it is understandable why some shoppers choose to cancel the entire order instead of searching for an alternative item. Confusing shipping rates can also result in a disappointing shopping experience.

(Source: Harry Köster Fotografie / myTime.de)

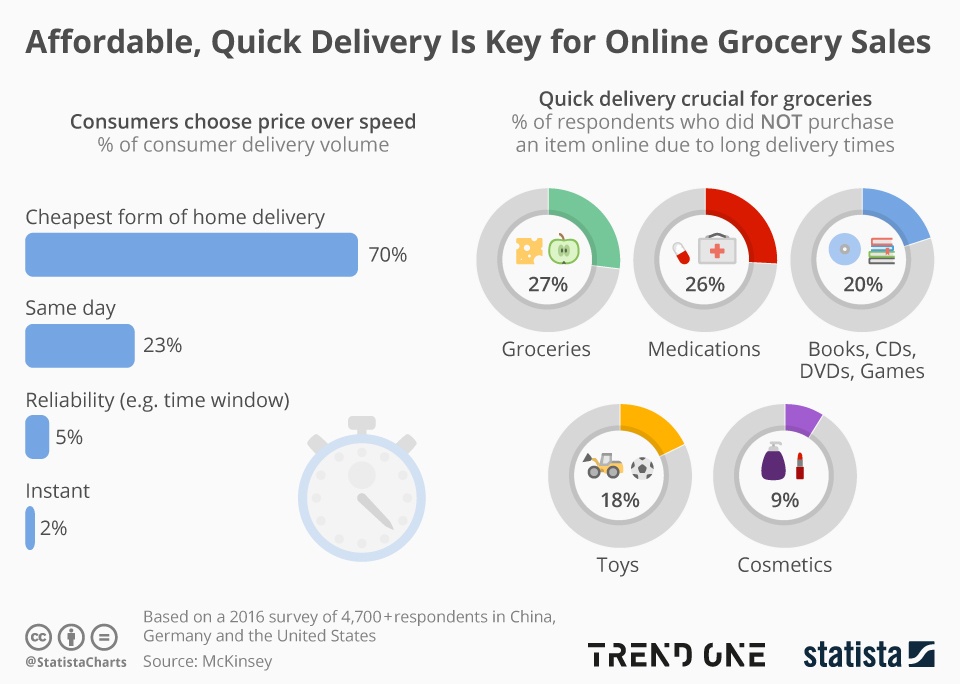

To drive conversion rates, a simple ordering and checkout process and a clear design of websites and apps are crucial. What’s more, consumers appreciate tight delivery windows and a speedy delivery. During the week, Edeka‘s Bringmeister offers same-day delivery for orders made before 2 pm and provides one-hour delivery windows.

However, there is a caveat. So far, Bringmeister is only available in Berlin and Munich. And generally speaking, fresh delivery service coverage is currently primarily available in metropolitan areas, which already enjoy a high density in terms of supermarkets. Meanwhile, rural areas have to resort to online supermarkets in the parcel delivery market. And sometimes consumers might actually be lucky enough to be close to a local service provider.

Challenging: Shipping perishable foods

The big challenge in shipping a mixed item shopping cart is the delivery of frozen and refrigerated products. Service providers have come up with different solutions for this. Online supermarkets that ship orders via parcel services usually rely on passive cooling techniques with special cold boxes featuring dry ice or cooling elements. Meanwhile, Food.de and Rewe rely on their own respective delivery services with refrigerated trucks and vehicles.

In these cases, the purchase is simply packed and delivered in paper bags and customers have to be home to receive the items. Deliveries in insulated shipping boxes using solutions such as parcel stations near the house or in-house parcel delivery boxes and shipment release authorizations are also viable options. In contrast, consumers don’t utilize click and collect alternatives as much, and retailers now tend to reduce them in volume versus expanding them.

Growth opportunities thanks to convenience aspects

Needless to say, it is definitely more complicated to send fresh groceries to customers than it is to ship clothing or decorating items. Having said that, grocery retailers are also passing up some great opportunities. Obviously, if you need to buy a carton of milk or two tomatoes on your way home from work, you are most likely to go to the supermarket in town versus ordering these items for delivery with your smartphone. You don’t pay shipping costs, get the milk right from the shelf and pick the tomatoes that look freshest to you.

(Source: McKinsey / statista.com)

However, there are great opportunities for online retailers when it comes to the weekly shopping segment and items that customers purchase time and again. Opportunities that are so far passed up by most retailers. “The German online food retailing market is an attractive segment that is likely to cause fierce competition and ultimately forces brick-and-mortar retailers to join in,“ warns Dr. Mirko Warschun, Head of the Consumer Industries and Retail Practice in Europe, the Middle East and Africa at A.T. Kearney. A great offer that complements the benefits of grocery delivery for consumers with added features such as shopping lists, nutrition consulting services, product and recipe suggestions or price comparisons, wins over many customers and can shape their buying behavior.

recommend